by andrew | Apr 2, 2018 | Mindset For Success

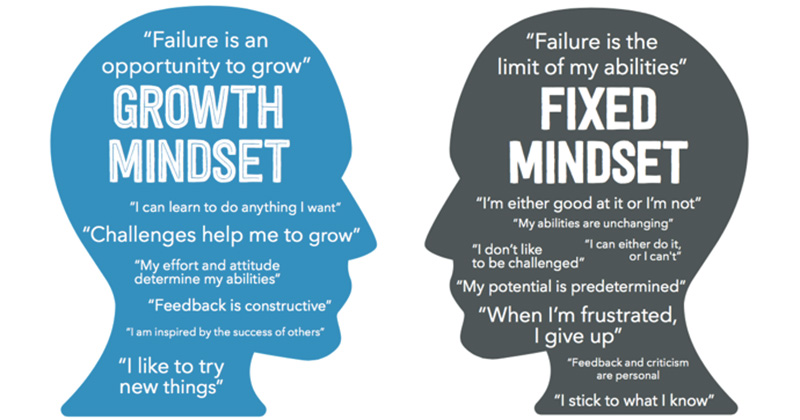

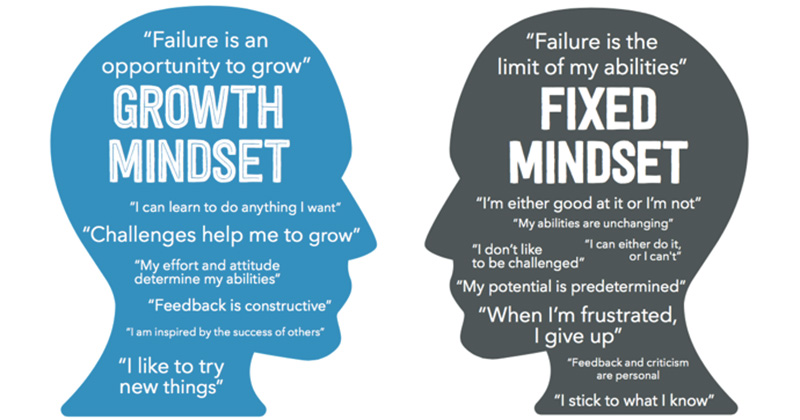

Do you spend time worrying that you aren’t good enough to succeed? That you’re just not capable or that you aren’t smart enough? You’re not alone. In this article, you will learn how our mindset matters in everything we do.

Your Mindset Matters

Do you have a growth or a fixed mindset?

Susan David in her HBR article “How To Manage Your Inner Critic“ gave some really good tips. She states, quieting your inner critic takes a series of specific steps:

First, it is important to recognize that the most commonly used strategy — trying to ignore or suppress your inner critic — simply doesn’t work. Rather than suppress your emotions, acknowledge that they are real, whether justifiable or not. The trick to dealing with your inner critic is to develop a balanced relationship with it. More or less learning how not to ignore it and the emotions it raises, yet also not allowing yourself to be bullied by it.

Second, examine your inner critic. Ask it: “Where do you come from?” This might feel awkward at first, yet speaking internally with your critic is a valid technique that encourages you to think objectively. We’re influenced by many factors, including competition with our peers, the media, our relationships with our significant others, and more. Once you understand the places your inner critic comes from, you’ll be able to recognize when it’s telling you the truth and when to disregard it.

Third, understand that your inner critic can actually help you. Your inner critic has evolved to help you set and meet high expectations. If you’re open to it – which is not the same as believing everything it tells you – then you can learn from it. Like a good coach, your inner critic reminds you that knowledge and capability are important. Ask it: “How will you help me achieve success in the task ahead?”

Forth, act in spite of your inner critic. You can learn from your inner critic. Yet be careful to not give it too much power. Find and maintain the right distance — keep it close enough to be useful, but not so close that it gets in your way. As soon as you hear your inner critic complaining, acknowledge the information — but always ask: is my inner critic helping me or hurting me? If what it’s telling you saps your confidence, then ask it to step aside and continue on your way

In the end, it’s helpful to remember that as loud as your inner critic can be, it’s just a part of you and not the whole. Don’t let it stop you from continuing to take action, learn and grow.

by andrew | Mar 26, 2018 | Priorities and My Time, Productivity, Service

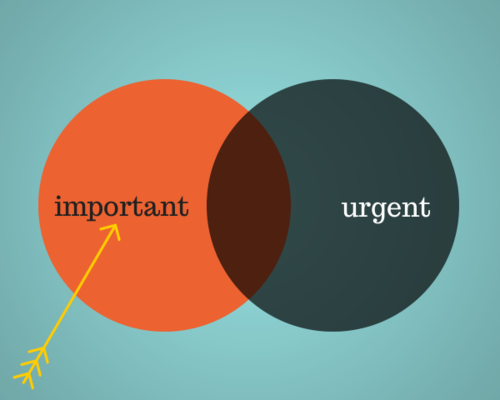

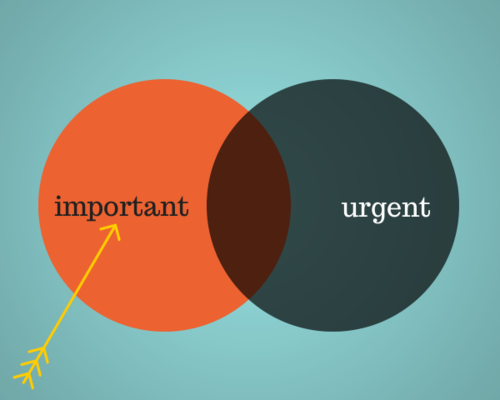

The most URGENT or the most IMPORTANT?

What matters most – the most urgent or the most important?

If you are like me, you face the challenge each day of choosing to handle what is urgent and what is important. I’ve been struggling with this balance lately and wanted to re-ground myself in those things I know are important, helpful and useful in focusing on those activities that make a true difference.

Every expert I’ve asked agrees – if you let urgent matters consume your time, you’ll never get to those important projects, activities or tasks. In many cases, those important projects, activities, and tasks are the ones that generate the most revenue, creates the most satisfied clients or help you be more productive in delivering an exceptional consumer experience. The word project here does not necessarily mean a specific project it could be a task or activity. For example cultivating relationships with clients, vendors or co-workers, acknowledging a job well done, taking time to improve a skill or focus on your health by exercising, are all important but not urgent activities.

Stephen Covey recorded an exercise with rocks of different sizes (small, medium and large rocks) and a glass pitcher. Students see all the rocks in the container and the instructor empties the container and then has a student try and get all the rocks back in the pitcher. Most if not all, the students failed to get all the rocks back in – they typically start by placing all the small rocks in the pitcher and then trying to stuff the remaining large rocks into the pitcher. The instructor steps in, place the big rocks in the pitcher first, and then all the little rocks fall into place and they all fit!

Start with the BIG rocks first.

Few of us have the luxury of focusing on just the urgent or just the important; to be successful you must be able to manage the important and the urgent. How can you handle both?

Keep the big picture priorities in front of you at all times. Do you have a “top 5” list? What are the outcomes you what to achieve? By keeping the big picture close to you it makes it easier to get back on track after an “urgent” distraction is handled.

Turn your email off and only focus on email during specific times during the day.

Schedule your important items as actual appointments – schedule specific times to focus on your most important projects when urgent matters don’t normally occur. The phrase, “How do you eat an elephant? One bit at a time” comes to mind.

Urgent matters get in the way, so plan for it! There are certain things in our business that we can plan on happening. These urgent matters draw you away from your important priorities. Schedule these interruptions as part of your daily routine.

Before you tackle an urgent matter, ask yourself how important is it to do “right now.” Can it wait? Can someone else handle this? Is it an excuse to get off task and avoid the harder work of the important project list?

What you measure you can manage. Here is a proposed action plan to help you see your own pattern. This week, keep a journal and take note of the following:

- What task or project you are working on?

- How much time are you devoting to this task?

- Why are you doing this task?

What you measure you can manage and improve.

At the end of each day write a “U” for urgent or “I” for important next to each entry. How do these activities relate to your big picture and overall priorities?

After the week is over, read through your journal and cover these 7 areas:

- How many U’s and I’s did you have?

- Are you closer to achieving your big picture or farther away?

- How many U’s could have been bypassed or delegated to others?

- How does the U’s interfere with your I’s?

- If your number of I’s is low, what got in the way?

- How can you better manage or cut out some of these U’s?

- Are you avoiding your I’s?

If urgent items keep getting in the way, stop the madness. Talk to a trusted advisor, business coach or counselor and get clear on some strategies and tactics that will work for you in staying focused on the important while handling the urgent.

by andrew | Oct 24, 2017 | Real Estate, San Antonio

Selling a home can be a difficult task for even the most seasoned of sellers. There is so much that goes into the process of placing a property on the housing market. First, the owner needs to get the home in condition to present it to potential buyers. From there, taking proper pictures that display your residence in its best light is a must. These are the images that are going to grab the attention of those that are searching through the housing market. Unfortunately, even the best pictures don’t ensure that your property will be seen. After all, you are competing with your neighbors for the attention of a select few.

As with any competition, it is important to find an edge. This is where an experienced realtor can be your ace in the hole. With an extensive list of interested buyers, as well as the knowhow to market your listing to a greater audience, real estate agents make it their mission to get the most money for your property. When you have a team of skilled agents on your side, the competition gets left in the dust!

Original Article: http://www.jparsanantonio.com/blog.php

by andrew | Oct 24, 2017 | Dallas, Real Estate

Think you have to wait three to seven years after a foreclosure before you can get a new loan? You may be able to cut that in half.

——

Typically, you have to wait for years after a foreclosure to get the financing necessary to buy a new home, but you may be able to get a loan much sooner if you improve your credit score, budget and save. Throw extenuating circumstances into the mix, and your wait time could be even less.

——

Were you one of the millions of Americans that suffered a foreclosure in the last several years? If so, you are well aware that it leaves a black mark on your credit and prevents you from obtaining the financing to purchase another home for three to seven years, or longer depending on how you handle your money after the foreclosure.

But, you may be able to drastically reduce your wait. In fact, if you are able to prove that you experienced an “economic event” that caused your household income to fall by 20 percent of more for a period of at least six month, you may qualify for financing within a year. You must be able to demonstrate, though, that you have fully recovered from that event and agree to complete housing counseling prior to closing.

Whether or not you have experienced a life-changing economic event, you can take steps to shave off time from that seven-year waiting period. Here’s what you need to do.

Improve your credit score.

A foreclosure can cause your credit score to drop by up to 150 points. In order to qualify for another home mortgage, you’ll have to compensate. Start by paying your bills on time.

Thirty-five percent of the points that make up your FICO Credit Score, the standard credit-scoring model used in today’s lending environment, is based on your payment history. Just to reiterate: that’s more than one-third of your credit score. If you have a poor payment history (in other words, a lot of late payments), you’ll have trouble qualifying for any loan because your credit score demonstrates you are a risk. The folks over at USnews.com agree, saying, “Accounts that are 90 days late will have a bigger negative impact on your score than those that are 60 or 30 days late. So pay off the most past-due accounts first, and gradually catch up on all your payments.”

Reducing your debt can also have a big impact on your FICO Credit Score. In fact, at 30 percent, a lower debt to income ratio the second largest factor in determining your credit score. Having some debt isn’t necessarily bad, but how you manage it can be. Visit MyFICO.com to learn exactly how debt can affect your score.

Other factors used to determine your credit score include how long you’ve had credit, the types of credit you use (retail, installments, etc.), and whether you’ve opened any new accounts.

Create a budget.

Having a budget is key to turning your finances around. Without a budget, it’s easy to miss payments or run out of funds before the next paycheck arrives, necessitating a credit card withdrawal that increases your debt and ultimately impacts your credit score. The good news is setting up a budget is relatively easy.

First, record all your sources of income. Then, gather your financial statements, including bank statements, utility bills, credit card bills, and any other payments. Add to that a list of your monthly expenses, such as car payments, auto insurance, groceries, utilities, housing costs, entertainment, and anything else you spend money on. (Be specific.) This should give you a good indication of what’s coming in and what’s going out.

Next, total your income and expenditures and make adjustments as needed. You may find you need to cut out that double latte, or you just might find that you have some extra money every month that you can use to first reduce your debt and then to create an emergency fund. An emergency savings fund of three to six months’ worth of living expenses is key to demonstrating to a lender that you are prepared financially to manage a mortgage again.

There are several great programs and tools out there that can help you get your finances back on track, including Dave Ramsey’s Total Money Makeover and Mint.com.

Choose your future housing wisely.

Let’s be honest: you probably lost your house in the first place because you bought more house than you could afford or because you didn’t have a savings buffer set aside to help you get through a financial hiccup. Your newly established budget should help you avoid repeating that mistake. Once you know how much money is coming in and how much is going out, you will know definitively what you can afford to pay for housing. Note: you should limit yourself to house payments of no more than 28 percent of your total income.

Save for a down payment.

Again, if you want to buy a house again as soon as possible after you have go through a foreclosure, it’s essential that you have a budget to help you improve your credit score and save money. Once you have your emergency account fully funded, you need to save for a down payment on your next house. How much you’ll need in the bank depends on the cost of the house you intend to purchase (since the amount of the down payment is a percentage of the purchase price) and the type of loan you will be getting. Typically, for a conventional loan, you’ll want at least 20 percent to avoid private mortgage insurance.

Use extenuating circumstances to your advantage.

The FHA made it drastically easier for homeowners who’ve suffered a foreclosure to get a new loan by shortening the wait time if there’s been extenuating circumstances. But what qualifies as an extenuating circumstance?

First, the “economic event” that led to the foreclosure must have been something beyond your control such as a job loss or illness. Also, the event must have reduced your household income by 20 percent or more for a period of at least six months. This must be documented by an FHA-approved mortgage lender using tax returns, W-2s, terminations notices, employment letters, and more.

You also have to then reestablish your credit for a minimum of 12 months after the foreclosure with no late payments or other issues, and complete at least one hour of HUD-approved housing counseling.

If you complete these steps, you will be well on your way to re-establishing a promising credit score and securing a new mortgage – even after a foreclosure.

by andrew | Oct 24, 2017 | Dallas, Real Estate

The number of times a particular property is scheduled for a home showing is a good indication of how much interest buyers have in that listing. Similarly, tracking showings on a nationwide basis can offer a big-picture look at home buyer trends and the level of overall interest in buying a house.

According to recent numbers collected as part of the ShowingTime Showing Index, home showings increased 7.3 percent year-over year in September, with big increases seen in the Northeast and Midwest. In fact, the Northeast saw the biggest annual increase, rising 11.5 percent over the same time last year. The Midwest rose 8.3 percent and the West was up 7 percent. The South was relatively flat from last September, though that is likely due to the impact of recent hurricanes rather than any regional lag in buyer demand.

Taken as a whole, the data suggests that there is growing interest in homeownership among Americans, with significant increases in the number of home showings across nearly every region. However, since home sales aren’t showing equally large gains, it could be an indication that there are a lot of interested buyers but not as many homes available for them to buy.